Explaining the reasons for the differences between central banks and the government, Acharya had said, “A government’s horizon of decision-making is rendered short, like the duration of a T20 match...There are always upcoming elections of some sort. In contrast, a central bank plays a test match, trying to win each session but, importantly, also survive it so as to have a chance to win the next session.” (TOI had front-paged his remarks in its Saturday print edition)

Here are the six factors that led to the spat:

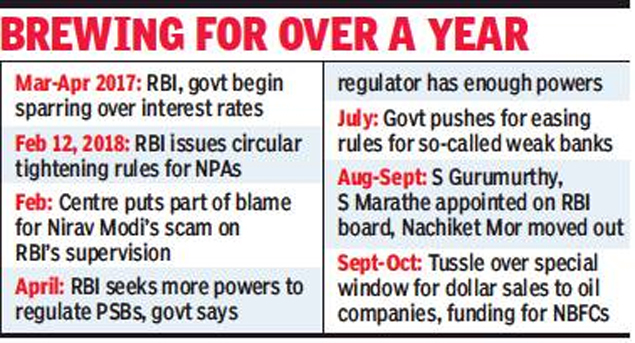

1) Not cutting interest rates: In 2018 alone, there have been at least half-a-dozen issues on which the two have taken opposing stands. While the rift began with the government unhappy with the RBI for not cutting interest rates – and even raising them – it spilled over into regulation, something the central bank believes is its exclusive domain.

2) Bad loans restructuring: RBI's February 12 circular on classification of non-performing assets and norms of loan restructuring was the next flashpoint. The government saw it as overly harsh, and indeed it drove all but two state-run lenders into the red.

3) Biggest banking scam ever: As the Nirav Modi fraud broke, the government hit out at RBI on supervision, drawing an almost-immediate rebuttal with RBI governor Urjit Patel seeking more powers to oversee public sector banks so that they are at par with their private sector peers.

4) IL&FS crisis: In addition, the government has been insisting that RBI step in to provide relief to non-banking finance companies (NBFCs), which are grappling with a cash crunch after IL&FS defaulted on repayments. The central bank has refused to play ball.

5) Nachiket Mor moved out: What has also irked the central bank brass is the way in which Nachiket Mor was removed from the RBI board more than two years before his term was to end without formally informing him.

6) Payments regulator: A separate payments regulator has been another friction point with RBI stating its position publicly on why it did not support the move. In fact, it went to the extent of releasing its dissent note on a separate regulator on its website.

from Times of India https://ift.tt/2Q40R1F