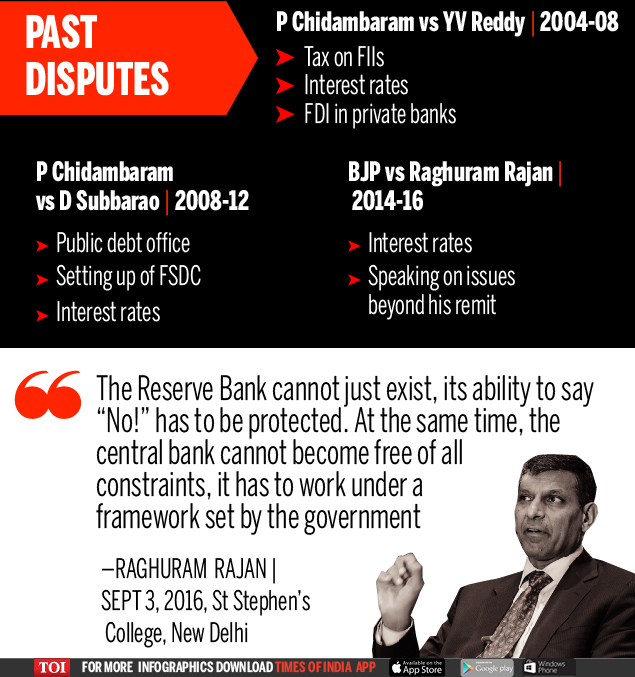

What is unusual about the current standoff is the number of issues it has spilt over to and the length of time it has gone on for. Interest rate, the perpetual point of sparrings, has been overtaken by several other turf wars.

10 flash points between Centre and central bank:

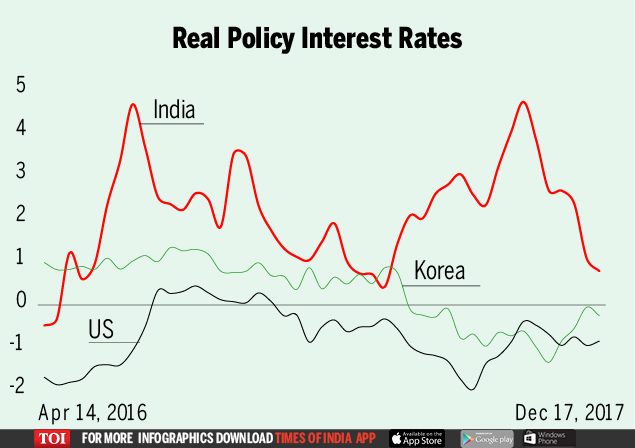

1) Interest rates: Urjit Patel’s tenure started seemingly cordially, with the governor seen to be backing demonetisation within weeks of his appointment in September 2016. But ties soon soured over the issue of interest rates when the Monetary Policy Committee (MPC) led by him refused to meet chief economic adviser Arvind Subramanian ahead of a decision on rates.

Arvind Subramanian (on June 7, 2018), the then chief economic adviser reacting to RBI’s refusal to cut interest rates had said: "In recent times, seldom have economic conditions and the outlook warranted substantial monetary policy easing. Inflation forecast errors have been large and systematically one-sided in overstating inflation.”

Economic Survey 2017-18: Tightening of monetary conditions ... depressed consumption and investment, compared to that in other countries and attracted capital inflows, which caused the rupee to strengthen, dampening both net services export and the manufacturing trade balance.

2) Dividend payment: RBI surprised the government by transferring only Rs 30,000 crore surplus against the budgeted Rs 66,000 crore, prompting the finance ministry to seek a higher payout, which the central bank had turned down.

3) February 12 restructuring: RBI banned all loan restructuring schemes and asked banks to set aside funds for potential losses (called provisioning) even in case of a one-day default.

Government and banks protested, arguing that this was not feasible.

RBI governor Patel (on March 14) at NLU, Gandhinagar had said: "We see the regulatory overhaul announced on February 12 as the Samudra Manthan of the modern day Indian economy. Until the churn is complete and the nectar of stability safely secured for the country’s future, someone must consume the poison that emanates"

4) Regulation of public sector banks: It started with the government ticking off RBI for its failure to detect the Nirav Modi-triggered fraud at PNB. Governor Patel responded by blaming the government for not giving the regulator the same powers as those for supervising private banks.

The finance ministry hit back saying that RBI had adequate powers and was even consulted on appointment of state-run bank CEOs.

5) Prompt corrective action: The RBI had placed half the public sector banks under lending restrictions by imposing its ‘prompt corrective action’ on them. The PCA forces the government to recapitalise the banks before they can lend again. The government has been nudging the RBI to lift these restrictions in the wake of the liquidity crisis.

RBI says it was the PCA that prevented these banks from creating more bad loans.

6) Payments regulator: An inter-ministerial committee for finalisation of amendments to the Payment & Settlement Systems Act, 2007 had suggested the creation of a payments regulator, which would bypass the central bank’s powers over payment and settlement systems.

In a dissent note, RBI had said that the payment system is bank dominated and its regulation by the central bank is the dominant international model.

7) Board appointments: Nachiket Mor, a veteran banker who was identified by Raghuram Rajan as a possible COO for RBI, was one of the most vocal critics of the government’s move to seek higher dividend. The former banker, who had been renominated by the Modi administration, saw his term cut short without prior information.

The government is accused of populating the board with hand-picked nominees, including RSS-linked S Gurumurthy and Satish Marathe.

8) Special dollar window for oil companies: The government was forced to allow oil firms to borrow overseas after RBI refused a special dispensation to help them meet their forex requirement.

9) Liquidity for NBFCs: The IL&FS default had led to a liquidity crisis for finance companies that do not accept deposits and are dependent on wholesale funds. This in turn was threatening to spill over to markets as nearly 40% of debt investment by mutual funds were in these financial companies. During a similar crisis in 2008, the RBI had enabled purchase of assets of NBFCs through a special purpose vehicle.

The government wanted to replicate this facility, which was opposed by RBI. As a result, government had to fall back on public sector banks to buy assets from NBFCs.

10) Reserves: The government has been eyeing the “surplus reserves” with RBI, arguing that most other central banks are not sitting on this kind of a cash pile. RBI is unwilling to let go of this kitty as it sees this as an important tool to manage exchange rate risks, which it believes should not be used to bridge the Centre’s fiscal deficit.

RBi deputy governor Viral Acharya (on October 26) had said: "Governments that do not respect central bank independence will sooner or later incur the wrath of financial markets, ignite economic fire..."

from Times of India https://ift.tt/2qiuLE7