Meanwhile, the investors are cautiously waiting to see if central bank and government policymakers could bridge differences over several key issues.

With nothing emerging from the meeting so far financial markets showed little movement.

The 10-year benchmark bond yield was at 7.81 percent compared with 7.82 at Friday's close, while the rupee was at 71.89 per dollar versus 71.92 on Friday. The broader NSE stock index was little changed at 0.3 percent.

Investors were on guard against any resurrection of the row between the central bank and government officials, but few were expecting fireworks as both sides have tried to dispel fears of a more serious fallout.

That has left traders still anxious to see how far the central bank might be ready to relent to meet the government's demands.

"Foreign investors will wait to get some cues from today's meeting on the extent to which the central bank is autonomous, but it will be good for bond markets in the short-term if the RBI gives in to the government's demand for more liquidity," said a dealer at a foreign bank.

The board meeting was specially convened to follow through on its last meeting on Oct 23, otherwise such meetings seldom draw attention as they typically focus on standard discussions on macro-economic variables.

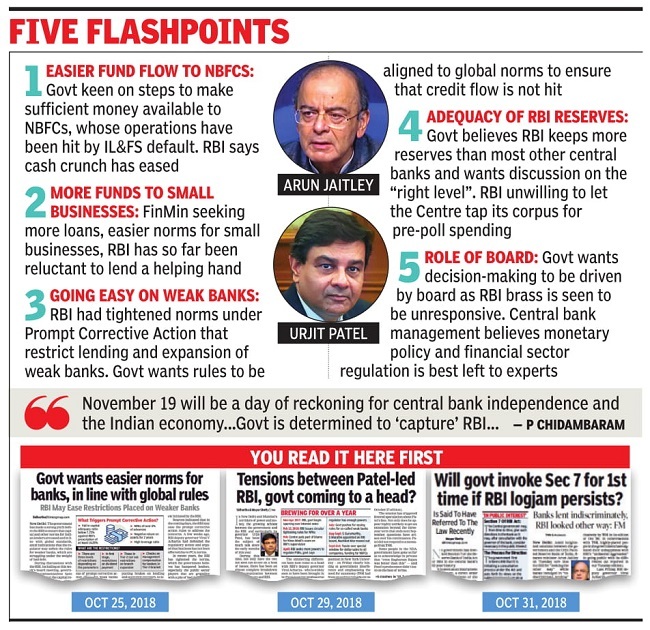

As reported first by TOI on November 2, RBI shied away from making decisions taken at the October 23 board meeting public, even though they had been agreed upon. At Monday's meeting, sources indicated, the two government representatives on the board will want RBI to announce the agreement that had been reached on easing credit flow to micro, small and medium enterprises (MSMEs), a revamped prompt corrective action (PCA) framework for weak banks, and alignment of capital norms for Indian lenders in line with international standards instead of making them more stringent. The government sees these as crucial steps to ensure more lending.

Top government officials and one independent director have pressed the RBI to ease lending and capital rules for banks, provide more liquidity to the shadow banking sector, support lending to small businesses and to let the government use more of the RBI's surplus reserves to boost the economy.

Unhappy over the pressure, RBI deputy governor Viral Acharya had warned that undermining the central bank independence could be "catastrophic".

The very public row led to speculation that RBI Governor Urjit Patel might resign, though officials have since sought to dampen such talk.

from Times of India https://ift.tt/2RZNakM