Finance minister Arun Jaitley announced in his budget speech that cryptocurrency was not legal tender (medium of payment recognised by law that can be used to meet a financial obligation). The finance minister also said he would take all measures to stop such currency being used in payments systems. Action by banks was expected. But the government made no move to ban the more than dozen or so cryptocurrency exchanges in India. And since the Union government had not called them illegal, it was business as usual for the exchanges.

But banks refusing transactions meant those who wanted to participate in crypto exchanges had to use other means. Those who had foreign accounts or family and friends overseas turned to those channels. Many exchanges asked their customers to be physically present in their offices to buy bitcoins for cash.

Harish and Viswanath’s Unocoin exchange hit on the idea of using an ATM-like machine that would accept cash in exchange for bitcoins.

“If banks won’t let you buy or sell bitcoins, why not an ATM to handle those purchases in cash?” Sathvik reasoned when he spoke to TOI before his arrest.

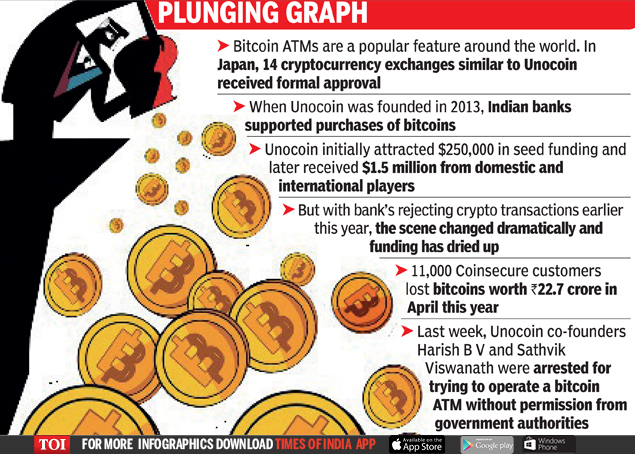

Bitcoin ATMs are a popular feature around the world, particularly in Japan where 14 cryptocurrency exchanges similar to Unocoin have received formal approval.

The Bengaluru police though took a dim view of Unocoin’s ATM idea. It’s not entirely clear why they arrested the two co-founders. Was it because Unocoin had not obtained a licence to install the ATM-like machine? Or was it because they believe crypto is illegal? There are plenty of grey areas in the matter. Unocoin insists the Indian government has not categorised crypto as illegal. If that is the case, then nobody can stop people from dealing in it.

The global bitcoin market is currently worth more than $300 billion and has seen bitcoin ATMs popping up in malls, restaurants and airports.

The growing demand for ATMs is met by ATM makers such as Hyosung, Genesis, Diebold and NCR, who have branched out into bitcoins apart from their regular cash ATM machines. Unocoin’s bitcoin ATM was manufactured by NCR which made one modification for the Bengaluru machine — it disabled slots for insertion of credit and debit cards since the banking system does not allow crypto trading.

When Unocoin was founded in 2013, Indian banks did support purchases of bitcoins. Investors also saw potential in bitcoin exchanges. Unocoin initially got $250,000 in seed funding from an international bitcoin player and later, in September 2016, received $1.5 million from domestic and international players.

The faith in bitcoins was strong among many, although the fine print for investors back even then stated that the “regulatory environment” is an investment risk.

Unocoin’s success helped other exchanges including Zebpay, Coinsecure and Koinex attract funding.

But with bank’s banning crypto transactions, the scene dramatically changed. Zebpay closed operations in September. Coinsecure shut down after a massive hack that saw 11,000 of its customers lose Rs 22.7 crore. Funding too has dried up.

“We didn’t see this coming,” said an investor in Unocoin. “I mean you can buy porn, lottery tickets or violent video games, using your debit card. So why not bitcoins? We never thought the day would come when banks would make moral decisions for people.”

Perhaps, it wasn’t a moral decision. The government has been worried about bitcoins being used for money laundering activity and funding terrorism. Tracing bitcoin users is difficult, unlike with regular bank accounts where KYC documents provide clues to the perpetrators of crime.

To deal with the anonymous issue, cryptocurrency players in India decided they needed to know more about their customers. In a bid to create a self-regulatory mechanism, Zebpay, Unocoin, Coinsecure, and Search Trade created the Digital Asset and Blockchain Foundation of India (DABFI) in December 2017. It’s not clear how successful the initiative has been. TOI contacted seven of the leading cryptocurrency exchanges in India, but did not receive a response from any of them. Few seem eager to support Unocoin publicly.

Bright start, hazy future

Sathvik Viswanath (left in pic) and Harish B V come from ordinary middle-class backgrounds. Sathvik did his schooling in Vidyaniketan in Bengaluru, and his engineering at Siddaganga Institute of Technology, before pursuing higher studies in Melbourne. Harish was his batchmate in college and studied computer science. In January 2013, when Sathvik was a freelancer for a video game company in San Francisco, he realised a significant portion of his payments was going to intermediaries like PayPal. He realised the best way to avoid this was to be paid through bitcoins. The same year, he happened to meet Abhinand Kaseti and Sunny Ray at an Indian bitcoin meet. The three of them along with Harish decided to launch Unocoin. Today, the future of their venture looks cloudy.

from Times of India https://ift.tt/2SuRee3