What is the size of the RBI’s balance sheet?

In 2017-18, the size of RBI’s balance sheet was Rs 36.2 lakh crore. Its balance sheet, however, is unlike that of a company. The currency notes it prints make up more than half its liabilities. Another big share, 26%, represents its reserves. These are invested mainly in foreign and Indian government securities (essentially promisory notes bearing an interest rate against which these governments borrow) and gold. RBI holds a little over 566 tons of gold, which along with its forex assets make up almost 77% of its assets. Sometimes, the finance ministry and RBI disagree on what level of reserves RBI must hold to be consistent with its operations.

Where do the RBI’s reserves come from?

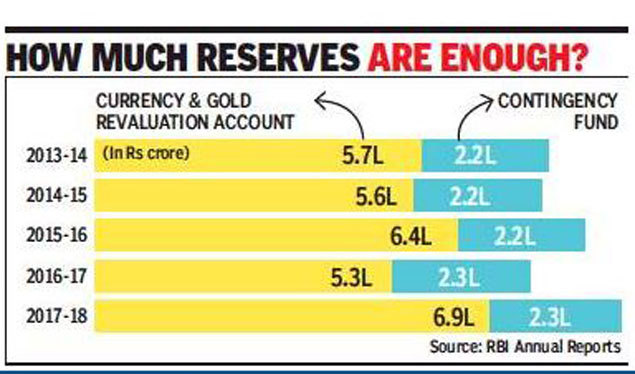

Reserves with RBI are not all of the same kind. In the current debate there are two which are relevant: The Currency & Gold Revaluation Account (CGRA) makes up the biggest share — it was Rs 6.9 lakh crore in 2017-18. This represents the value of the gold and foreign currency that RBI holds on behalf of India. Simply put, variations in this represent the changing market value of these assets. Thus, the RBI notionally gains or loses on this count according to market movements. For example, last year the CGRA increased by 30.5% largely because of the depreciation of the rupee against the US dollar and due to an increase in the price of gold.

The Contingency Fund (CF) is a specific provision meant for meeting unexpected contingencies that arise from RBI’s monetary policy and exchange rate operations. In both cases, RBI intervenes in the relevant markets to adjust liquidity or prevent large fluctuations in currency value. The CF in 2017-18 was Rs 2.32 lakh crore, or 6.4% of assets. The CGRA and CF put together constituted 26% of assets (and because in a balance sheet assets and liabilities must by definition match, also the same proportion of its liabilities).

What is the RBI’s surplus?

This represents the amount RBI transfers to the government. There are two unique features about RBI’s financial statements. It is not required to pay income tax and has to transfer to the government the surplus left over after meeting its needs. RBI’s income comes mainly through interest on the securities it holds and in 2017-18 the largest component of expenditure was a provision of about Rs 14,200 crore it made to the contingency fund.

Obviously, the larger the provision made to CF, the lower the surplus. Beginning 2013-14, RBI didn’t make a provision to CF for three successive years as a technical committee felt its “buffers” were more than enough. In the last two years, however, RBI has made provisions to CF. The adequacy of the current level of CF is one of the key issues likely to be debated extensively by the expert committee.

from Times of India https://ift.tt/2QdkcAs